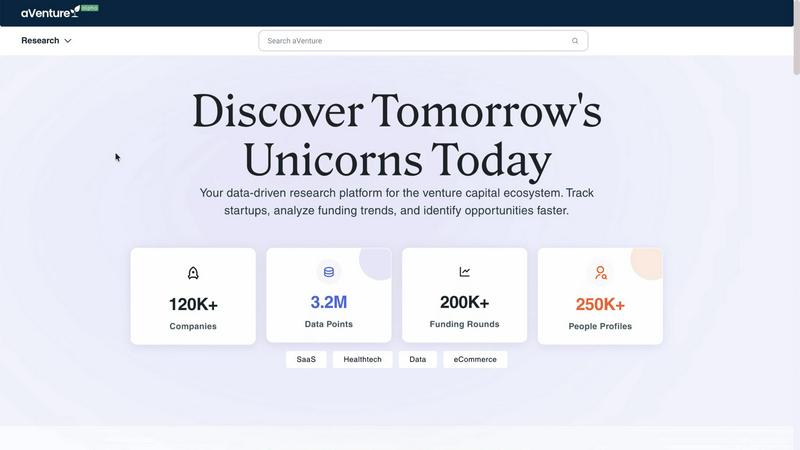

aVenture

aVenture is an AI-powered platform for comprehensive startup research and venture capital intelligence.

Visit

About aVenture

aVenture is an institutional-grade venture intelligence platform designed to bring clarity and strategic insight to the dynamic world of private markets. It serves as a comprehensive research engine, aggregating and analyzing data on over 109,000 venture-backed companies, 29,000 investors, and more than 12.8 million data points from over 1,200 sources. The platform transcends traditional databases by integrating a powerful AI analyst that reads the latest news and coverage to provide synthesized summaries, highlight potential risks, and explain how new events impact a company's trajectory. This combination of vast, verified data and intelligent synthesis empowers professionals to move beyond simple lookups and into strategic analysis. aVenture is built for a wide spectrum of users in the innovation economy, including founders benchmarking their market, investment analysts conducting deep diligence, business development teams scouting for partners, and operators monitoring their competitive landscape. Its core value proposition lies in transforming raw venture data into actionable intelligence, enabling users to discover opportunities, assess risks, and make informed decisions with confidence and speed.

Features of aVenture

Deep Company Insights

Go beyond basic profiles with comprehensive intelligence on over 100,000 private companies. Track detailed ownership structures, complete funding histories, competitive positioning, and key operational signals. This feature provides the depth of analysis institutional investors rely on, offering a holistic view of a company's health, market standing, and growth trajectory to support rigorous due diligence and investment thesis validation.

AI-Powered Analyst & Signal Tracking

Stay ahead of material developments with an AI engine that continuously monitors news and coverage. It delivers concise, actionable updates that summarize traction, flag potential risks, and contextualize how new events—like product launches or executive changes—may affect a company's future. This cuts through the noise, ensuring you are alerted to meaningful changes without manual monitoring of countless sources.

Advanced Investor Mapping & Filtering

Build highly targeted outreach and research lists by exploring the complete portfolios of thousands of venture capital firms and angel investors. Filter their investments by critical parameters such as sector, investment stage, geographic focus, and deal size. This enables precise market mapping, competitor analysis, and the development of strategic fundraising or partnership campaigns.

Collaborative Workspace Tools

Organize and share research efficiently within teams. Save custom lists of companies and investors, annotate profiles with private notes, export structured data for external analysis, and securely share findings with colleagues. These tools streamline collaborative workflows, ensuring that critical market intelligence is centralized, accessible, and actionable across an entire organization.

Use Cases of aVenture

Investment Due Diligence & Deal Sourcing

Investment professionals use aVenture to conduct thorough due diligence on potential targets. They analyze funding history, cap tables, competitor landscapes, and recent news synthesized by the AI analyst to assess valuation, identify red flags, and validate growth narratives. The platform also enables proactive deal sourcing by filtering companies based on specific sector, stage, and geographic criteria.

Competitive & Market Intelligence

Founders and operators leverage the platform to monitor their competitive landscape. They discover look-alike companies, analyze competitors' fundraising moves, hiring trends, and news coverage to refine their own positioning and strategy. BD teams use it to scout for potential partners, customers, or acquisition targets by mapping out entire market ecosystems.

Fundraising Preparation & Investor Targeting

Startups preparing for a fundraise use aVenture to identify the most relevant investors. They analyze VC portfolios to find firms with a proven interest in their sector and stage, understand recent investment patterns, and build a targeted, evidence-based outreach list to increase the efficiency and success rate of their fundraising efforts.

Thematic Research & Trend Analysis

Analysts and strategists employ aVenture to track emerging trends and thematic investment areas, such as AI, cleantech, or healthtech. They can follow companies and funds within a theme, receive curated news on sector developments, and generate reports on capital flow and emerging leaders to inform long-term strategic planning and investment theses.

Frequently Asked Questions

What types of companies are tracked on aVenture?

aVenture tracks over 109,000 active, venture-backed private companies globally across 132 countries. The database focuses on high-growth startups from seed to late-stage, encompassing a wide range of sectors including SaaS, Fintech, Biotech, AI, and Cleantech. It includes detailed profiles on their funding, investors, competitors, and key news.

How does the AI analyst work?

The AI analyst continuously scans and processes articles, press releases, and news from a vast array of sources. It doesn't just aggregate links; it reads and synthesizes the content to generate concise summaries that highlight a company's traction, pinpoint potential risks, and explain the significance of new events. This provides users with contextual intelligence, saving hours of manual reading.

Can I export data from aVenture for my own analysis?

Yes, aVenture includes robust workspace tools that allow users to export data. You can save lists of companies or investors and export the underlying structured data (such as company details, funding rounds, or key personnel) into standard formats for further analysis in spreadsheets, presentations, or other business intelligence tools.

Who is the typical user of aVenture?

aVenture is designed for professionals who need deep insight into private markets. Primary users include venture capital and private equity analysts conducting due diligence, founders and startup executives researching competitors and investors, business development teams scouting for partnerships, and corporate strategists tracking industry trends and innovation.

You may also like:

finban

Plan your liquidity so you can make decisions with confidence: hiring, taxes, projects, investments. Get started quickly, without Excel chaos.

Zignt

Zignt is a secure platform that automates contract workflows for fast, compliant, and legally binding e-signatures.

iGPT

iGPT transforms email data into trusted, context-aware insights for efficient enterprise workflows and agent interact...