MyUser

About MyUser

MyUser is designed to simplify online payment processing for businesses. It enables instant payouts and offers a unique approach by eliminating holds and disputes. With a quick onboarding process, MyUser serves e-commerce and high-growth startups, ensuring they can manage transactions effectively and efficiently.

MyUser provides a flexible pricing structure starting at 2% per successful payment, with a $1 fee per login and initiated payment. Special discounts are available for Y Combinator participants. This competitive pricing enhances value, particularly for businesses handling large transaction volumes.

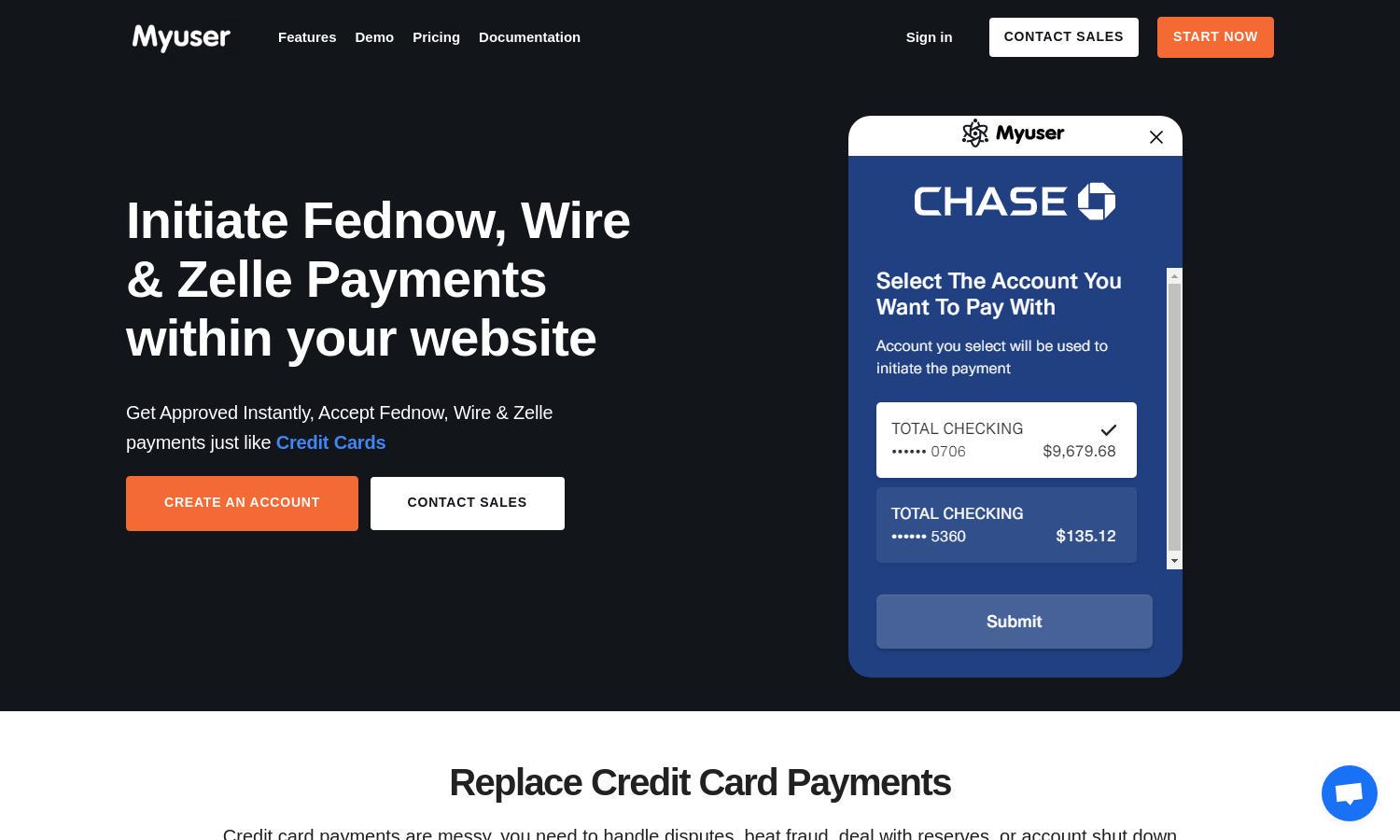

The user interface of MyUser is intuitive, ensuring a seamless experience. Its easy-to-navigate layout allows users to access features quickly while providing real-time payment notifications. This design emphasizes user-friendliness, making financial management straightforward for all businesses.

How MyUser works

Users begin by signing up for MyUser, experiencing an instant approval process that allows them to start accepting payments within minutes. After onboarding, they can navigate the user-friendly interface with ease, integrating the API to streamline transactions. Instant payout notifications enhance user engagement, while direct payments mitigate risks associated with traditional payment processors.

Key Features for MyUser

Instant Payouts

Instant Payouts is a standout feature of MyUser, allowing businesses to receive payments directly from users' banks instantly. This feature minimizes waiting times associated with traditional payment methods, ensuring seamless cash flow and improving overall business efficiency.

No Holds or Disputes

MyUser eliminates payment holds and disputes, ensuring a hassle-free transaction process. This unique selling point provides businesses peace of mind as funds flow directly from customers’ banks, enhancing reliability and simplifying financial management.

Real-time Payment Notifications

MyUser offers real-time payment notifications, keeping businesses informed at all times. This feature allows users to track the approval or decline of transactions instantly, increasing transparency and improving operational efficiency, which fosters trust with customers.

You may also like: