Skwad

About Skwad

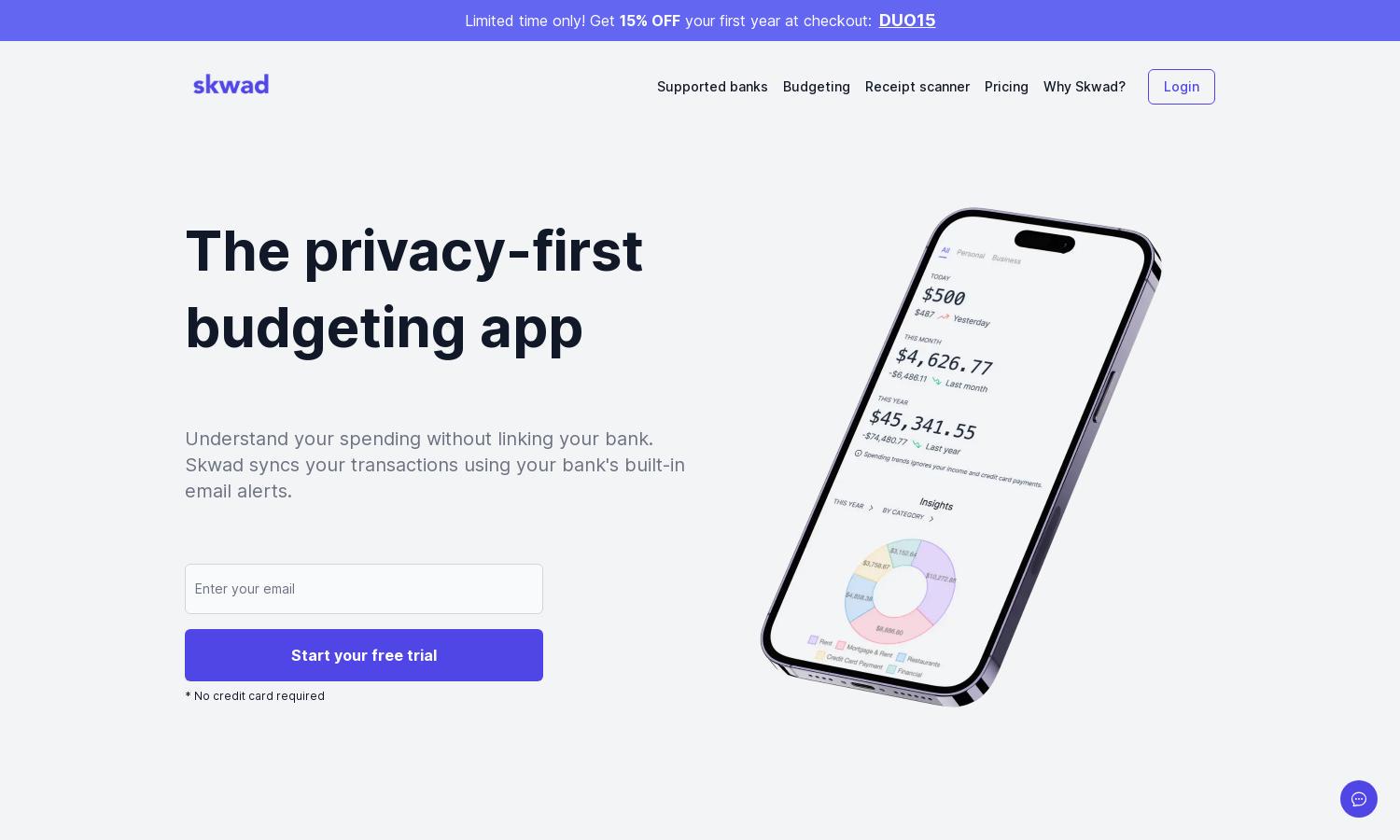

Skwad is an innovative budgeting app that emphasizes user privacy and security. By harnessing bank email alerts, users can effortlessly track their spending and income without sharing sensitive login credentials. Ideal for individuals seeking financial clarity, Skwad simplifies personal finance management while protecting user data.

Skwad offers different pricing tiers to accommodate various user needs. Users can start with a free trial and receive a 15% discount on their first year with code DUO15 at checkout. Each subscription plan includes comprehensive features that enhance user experience and financial management efficiency.

Skwad features a user-friendly interface designed for seamless navigation. Its intuitive layout allows users to easily access budgeting tools, view categorized transactions, and manage alerts efficiently. By focusing on simplicity and accessibility, Skwad ensures users can effortlessly stay on top of their financial journey.

How Skwad works

To start using Skwad, users sign up and receive a unique scan email address. They then set up automated alerts from their bank, forwarding these alerts to Skwad. The platform intelligently categorizes the transactions based on the alerts received. With no bank login required, Skwad ensures fast, secure, and efficient financial tracking.

Key Features for Skwad

Automated Transaction Categorization

Skwad's automated transaction categorization feature allows users to effortlessly track their spending without logging into their bank accounts. By converting email alerts into categorized transactions, Skwad offers a unique solution that enhances financial clarity while prioritizing user security and privacy.

Customizable Expense Tracking

Skwad provides customizable expense tracking options, allowing users to tailor their budgeting experience. Users can recategorize transactions, split expenses, and add receipt data, making Skwad a flexible tool that adapts to individual financial goals and reporting needs.

Multiplayer Budgeting Mode

Skwad's multiplayer budgeting mode enables users to share budgets and insights with companions. This collaborative feature fosters accountability in financial journeys, allowing users to eliminate debt together while maintaining a secure and private environment for their transactions and budget discussions.