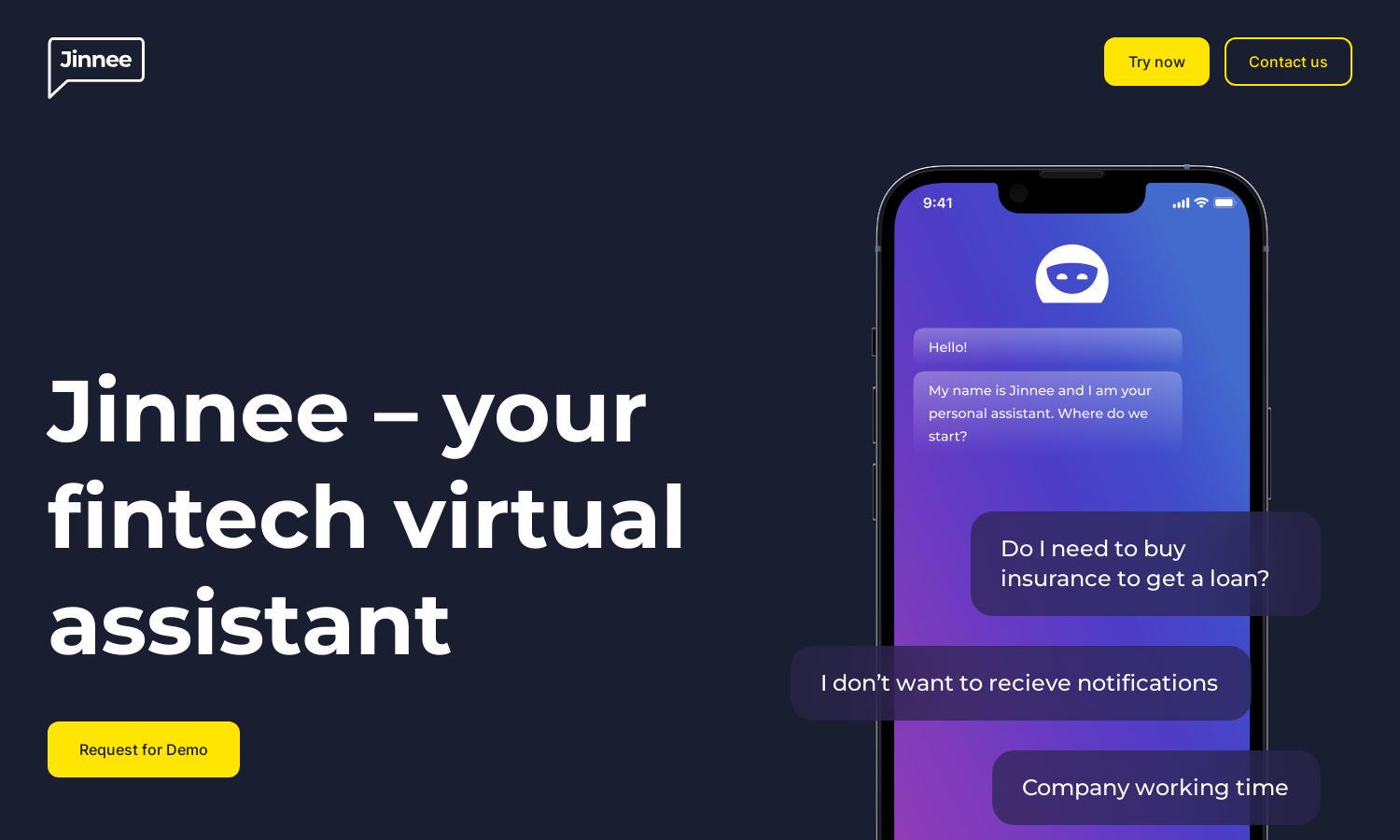

Jinnee

About Jinnee

Jinnee is a virtual assistant tailored for fintech companies, enhancing customer engagement through 24/7 support. By leveraging AI technology, Jinnee provides instant responses to inquiries and personalized banking services, helping users save time and simplify communication, ensuring high customer satisfaction and improved operational efficiency.

Jinnee offers flexible pricing plans to suit various businesses, featuring a basic tier for startups and advanced plans for larger institutions with added benefits. Subscriptions come with premium support and additional features. Users can gain greater insights and efficiency by upgrading to higher tiers, optimizing their customer service.

Jinnee features a user-friendly interface designed for seamless interaction, providing intuitive navigation through its functionalities. The layout supports easy access to analytics, chatbots, and additional tools, enhancing the overall user experience. This thoughtful design ensures that finance professionals can quickly adapt and utilize Jinnee for their needs.

How Jinnee works

Users can begin with Jinnee by signing up and going through a simple onboarding process tailored to their fintech needs. They can create customized chatbots using pre-made templates and visualize performance through analytics. The platform allows easy interaction through natural language processing, enabling rapid responses and enhancing customer satisfaction.

Key Features for Jinnee

Natural Language Processing

Jinnee’s natural language processing (NLP) capability uniquely enhances customer interactions by allowing financial institutions to understand and respond to inquiries instantly. This innovative feature recognizes customer queries, providing accurate information and improving satisfaction from day one, solidifying Jinnee as a premier fintech support solution.

Automated Learning

Jinnee’s automated learning feature is a standout, enabling the AI to continuously identify and learn from user intents. This ensures improved, context-sensitive responses over time, helping fintech companies adapt to evolving customer needs and providing a tailored experience that enhances user engagement and satisfaction.

Insightful Analytics

The insightful analytics feature of Jinnee provides valuable data on customer inquiries and interactions, allowing fintech companies to make informed decisions. By analyzing patterns over time, businesses can optimize their strategies and enhance service delivery, making Jinnee an indispensable tool for data-driven customer support.

You may also like: