Chart

About Chart

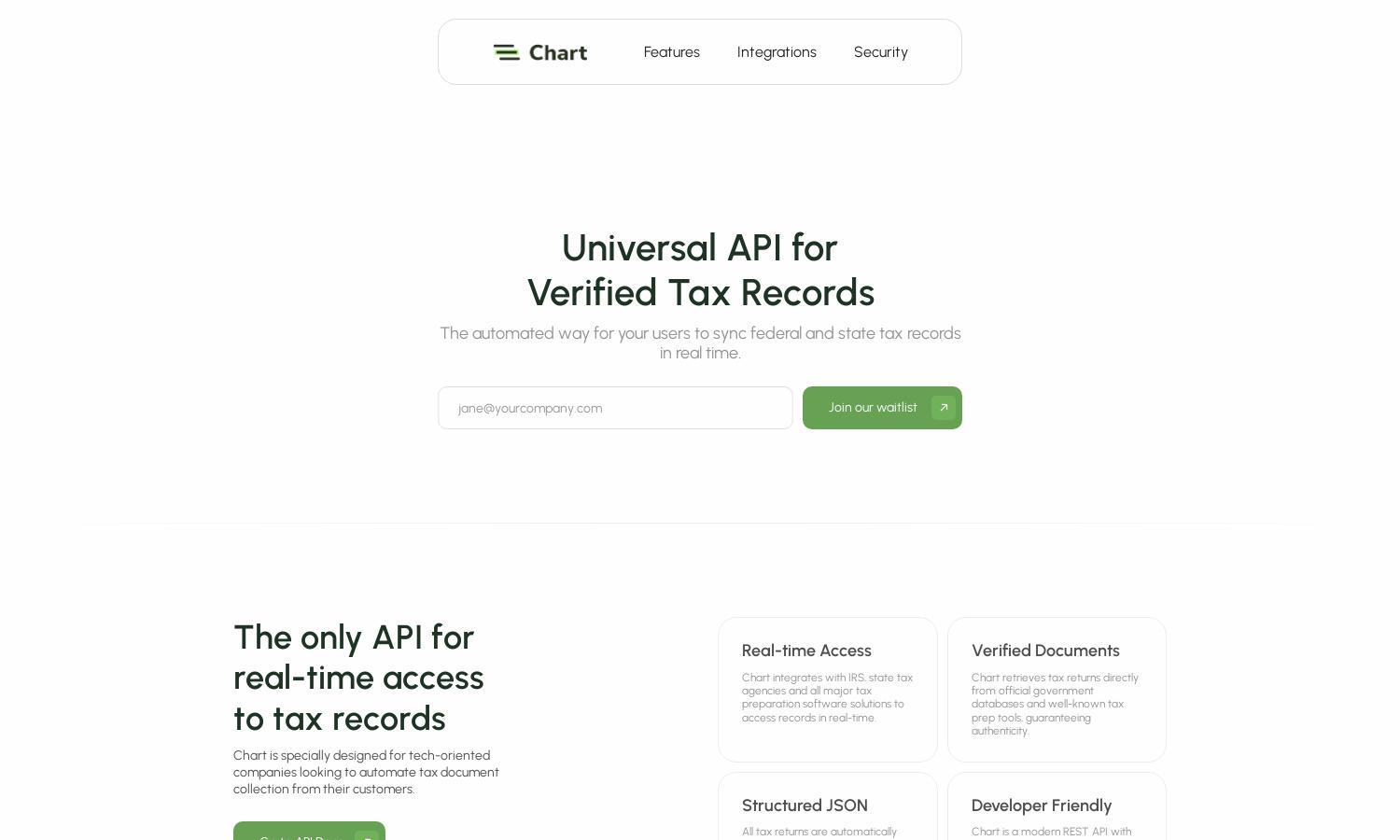

Chart simplifies tax document automation with its innovative API that provides real-time access to verified tax records from IRS and state agencies. Ideal for tech-savvy businesses, Chart processes tax documents seamlessly, enhancing user experience while ensuring compliance and data accuracy for efficient tax management.

Chart offers flexible pricing plans tailored to varying business needs, providing comprehensive access to its powerful tax document automation tools. Each tier unlocks advanced features and seamless integrations, encouraging upgrades for enhanced efficiency. Competitive pricing ensures that businesses can easily find a plan that suits their budget.

Chart's user interface is designed for seamless navigation, featuring a clean layout that enhances usability. Intuitive design elements guide users effortlessly through the tax document automation process. With user-friendly features, Chart ensures an optimal browsing experience, making tax automation accessible for all users.

How Chart works

Users start their journey with Chart by signing up and connecting to their IRS or state tax accounts. The platform’s guided setup allows for easy integration with tax preparation software or document uploads. Once set up, users can quickly retrieve verified tax records, ensuring efficient document collection with minimal effort.

Key Features for Chart

Real-time Access to Tax Records

Chart offers unparalleled real-time access to verified tax records through its unique integration with government agencies and tax software. This feature allows users to automate tax document collection, ensuring the accuracy and authenticity of data for seamless financial management, benefiting tech-oriented companies immensely.

Verified Document Retrieval

Chart guarantees authenticity with its verified document retrieval feature, directly sourcing tax returns from official government databases and reputable tax preparation tools. This enhances trust and security for users, ensuring they have access to reliable tax records for seamless and compliant financial operations.

Enterprise-grade Security

Chart prioritizes user security with non-persistent credentials, requiring re-login for each session, ensuring that sensitive data remains protected. This enterprise-grade security measure, combined with compliance frameworks, empowers users to manage tax records confidently, reinforcing trust in the platform's commitment to data integrity.