Blahget

About Blahget

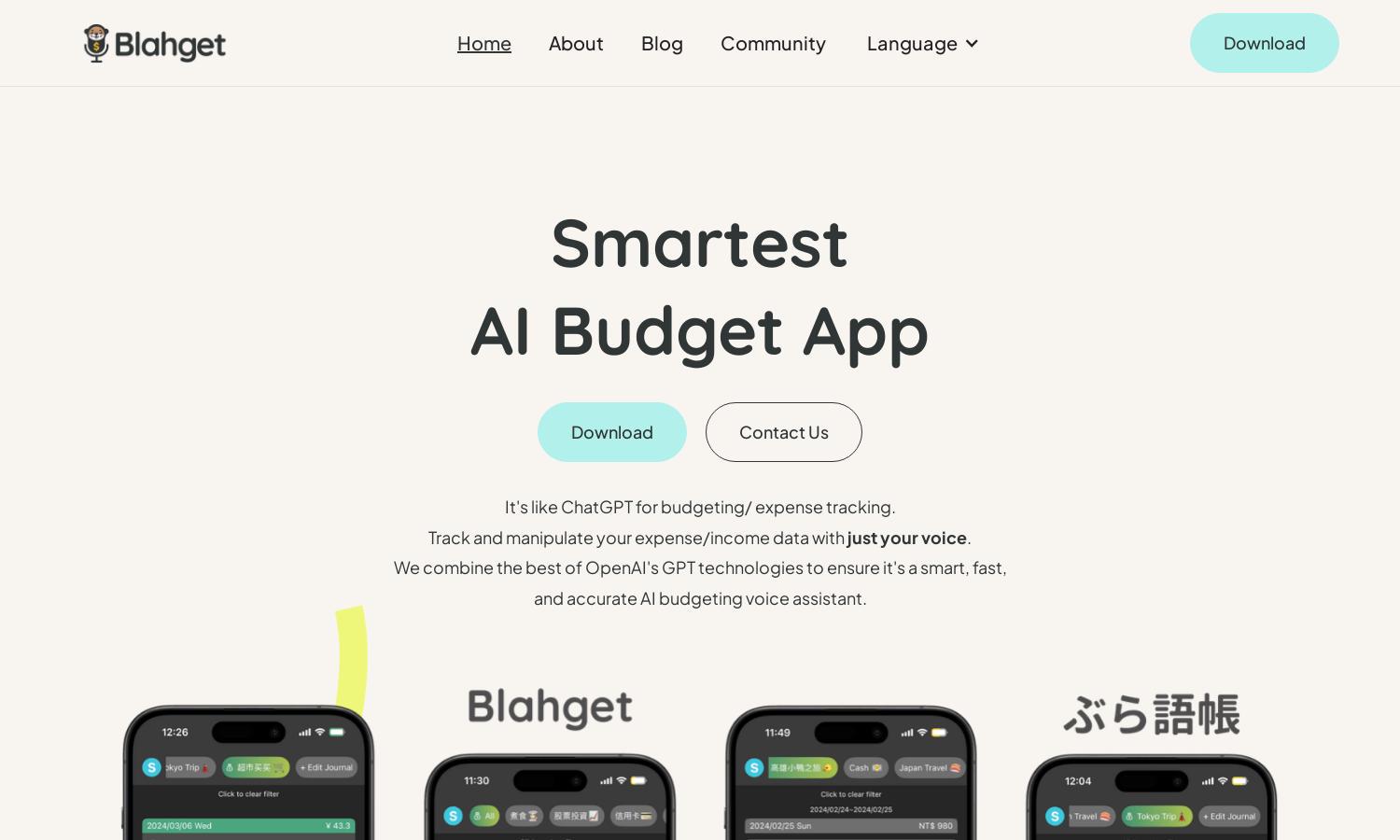

Blahget is an innovative AI budgeting assistant designed for users who want to simplify personal finance management. Utilizing advanced GPT-4 technology, it allows users to track expenses and income through voice commands, making budgeting effortless and effective for everyone.

Blahget offers a free usage tier for up to 50 transactions, with plans for premium features as user needs grow. While utilizing advanced AI technology, pricing will be reduced over time to enhance access for users, promoting smart budgeting habits without a financial burden.

The user interface of Blahget features a streamlined design that prioritizes ease of navigation and accessibility. With distinct voice-activated commands and user-friendly layouts, Blahget ensures a seamless budgeting experience, turning finance tracking into an engaging task rather than a chore.

How Blahget works

Users begin their journey with Blahget by downloading the app and creating an account, setting the foundation for effortless finance management. Using natural language, users can simply speak their expenses or income, which Blahget logs automatically. The app processes commands to allow for filtered searches, reporting, and more, enhancing user interaction and making budgeting as easy as a conversation.

Key Features for Blahget

Voice Recognition Technology

Blahget utilizes cutting-edge voice recognition technology, empowering users to log expenses and income seamlessly. This innovative feature allows for hands-free tracking, making budgeting effortless and transforming the way users manage their finances with an engaging and interactive experience.

Natural Language Processing

Blahget employs advanced natural language processing to comprehend and process user commands efficiently. This capability allows users to create, edit, and organize their financial entries effortlessly, providing a powerful tool for anyone looking to streamline their budgeting and enhance financial literacy.

Custom Reporting

Blahget provides custom reporting features that allow users to generate personalized financial insights. By simply asking, users can view their spending patterns, analyze trends, and make informed decisions to improve their budgeting strategies, ultimately enhancing their financial management experience.